Market Changes Affecting

Feedlot Placements

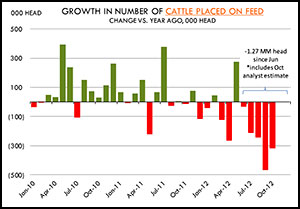

Sharply higher feed costs have forced a dramatic reduction

in the number of cattle placed on feed.

Since June, when corn prices started their upward move, feedlots have reduced feedlot cattle placements by almost 1.3 million head compared to the previous year (if we include the average October estimate). Some of this comparison may be skewed a bit by the fact that in 2011 feeders in the Southern Plains were forced to market calves early due to drought pressures and lack of adequate pastures.

This year, pastures in the Southern Plains were somewhat better, which limited placements of light cattle from that region. Still, overall U.S. pasture and range conditions in 2012 were even worse than in 2011. Which brings us back to corn and other feeds. While drought is a factor in pushing calves into feedlots, it is not a determinant. The matrix of feed, feeder-cattle and live-cattle prices is what determines the pace of feedlot placements.

Feedlot operators are adept at running least-cost formulations on their feed ingredients, but that becomes difficult when all feeds — corn, wheat, soy meal, distillers’ dried grains (DDGs), hay, etc. — increase by double digits in a matter of weeks.

Consider the following:

- cash corn in October at $7.76 per bushel (bu.) [Kansas City (KC) basis], +22%;

- winter wheat at $9.69 per bu. (KC basis), +23%;

- soybean meal at $490 per ton, +61%;

- DDGs at $290 per ton (KC basis), +26%; and

- hay at all-time record highs.

The drought and high feed costs have depressed feeder-cattle values, but not enough to offset the entire increase in feed prices. Also, the volatility in live-cattle markets and the inability of the beef cutout to break over $200 per hundredweight (cwt.) point to the fact that beef supplies will need to decline further in order to bring a margin back in the cattle-feeding business.

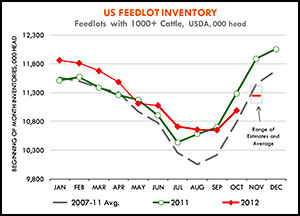

The drought and high feed costs have depressed feeder-cattle values, but not enough to offset the entire increase in feed prices. Also, the volatility in live-cattle markets and the inability of the beef cutout to break over $200 per hundredweight (cwt.) point to the fact that beef supplies will need to decline further in order to bring a margin back in the cattle-feeding business.USDA released on Friday (Nov. 16, 2012) the results of its monthly survey of feedlots with a capacity of 1,000 head of cattle or more. Analysts polled by Dow Jones ahead of the report all agreed that placements during October would continue to decline compared to year ago levels.

On average the expectation was for cattle placements to be down 12.7% from a year ago and 13.9% lower than the five-year average. It was a pretty aggressive estimate given that in October 2012 there were two additional marketing days than in October 2011.

On average the expectation was for cattle placements to be down 12.7% from a year ago and 13.9% lower than the five-year average. It was a pretty aggressive estimate given that in October 2012 there were two additional marketing days than in October 2011. The actual survey results came in very close to pre-report estimates and will likely have a limited impact on futures markets. Feedlot placements have been declining steadily since feed prices rocketed higher in June. Accumulated placements since June are down 1.3 million head. The survey indicated that as of Nov. 1, there were 11.254 million head of cattle on feed — 293,000 head, or 5.3%, less than a year ago.

October placements were 2.180 million head, 12.5% lower than last year, even with two additional marketing days. The current pace of placements is consistent with the forecast for a notable decline (-5% or so) in cattle slaughter in the first quarter and likely the second quarter of 2013. The expectation is for placements to continue to decline in the next two to three months as feedlots struggle with margins.

It is notable, however, that despite fewer cattle coming to market, overall beef production has held up relatively well, in large part because of big gains in cattle weights. Consider that for the period July through September, steer slaughter per marketing day was on average 1.5% lower than a year ago, but beef production was up 0.3% (note this is adjusted on a per marketing day basis). Steer weights are currently averaging around 873 lb. per carcass, 2% higher than a year ago. This has helped offset some of the slaughter reductions and keep beef prices in check.

The key risk to the market is if/when carcass weight gains slow down. Winter weather is always a wild card, more so today when feedlot supplies are especially tight.

Editor's Note: Reprinted with permission from The Daily Livestock Report (Vol. 10, Nos. 222 and 224; Nov. 15 and Nov. 19, 2012) published by Steve Meyer and Len Steiner. To subscribe visit www.dailylivestockreport.com.