Why Prime Still Pays

Days on feed and supply play in premiums.

The proportion of fed-cattle carcasses grading USDA Prime was up by one-third in 2018, bringing the annual share of Prime to 7.95%, over 2017’s average of 6%. That surge narrowed the spreads between the year’s Prime cutout value, USDA’s branded-beef category and commodity Choice.

Those differences stayed wide through July, with a Prime-Choice spread averaging $14.50 per hundredweight (cwt.), but from August forward, supply overcame demand, at times with the gap narrowing to $12.69 per cwt. The Prime-branded spread dipped from $10.13 per cwt. to $7.59 per cwt. on the same timeline.

In step, packers adjusted their grid premiums as last January’s Prime prize of $17 per cwt. over low Choice steadily eroded to a December finish at $9.90 per cwt. — just as the Prime grade volume trend peaked at 9.9% for the month.

Looking forward, some may question whether feedyards will continue to take cattle to the same days on feed for their grid or formula-bound pens in 2019 as they did a year earlier if the lower Prime value continues. Would they instead opt to forego a pursuit of carcass quality so as to cut inefficient final finishing days from the feeding period? Lighter carcass weights and earlier marketing dates would also result, bringing total fed-cattle tonnage lower and moving cattle ahead into the supply chain. The potential is there, but there are sound arguments against it.

First, the ability for feeders to take cattle to heavier finished weights effectively lowers the breakeven by spreading the purchase cost over more pounds gained. Current math suggests a 1,400-pound (lb.) finished steer has a $2.16 per cwt. lower breakeven sale price advantage over a 1,330-lb. steer, both placed on feed at 750 lb. This, and the desire to increase total revenue per head are likely the primary reasons why industry days on feed have crept higher in recent years.

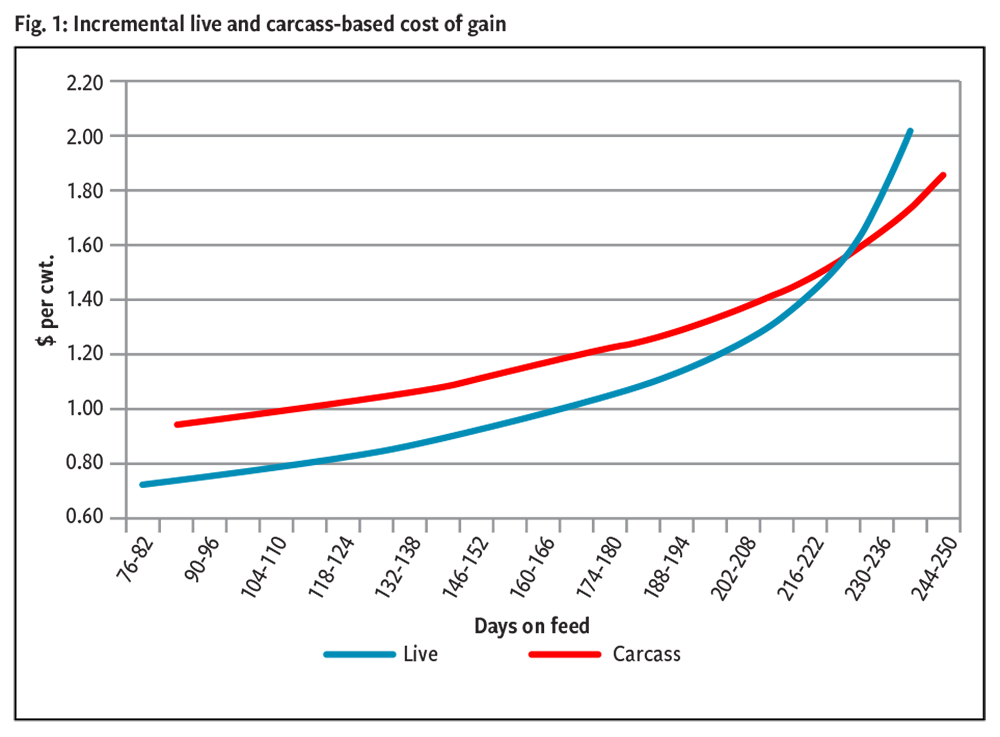

Second, if cattle are committed to a carcass-based pricing system, then dressing percentage is important and negatively affected when the feeding period is shortened below optimum fatness end point. Incremental feed conversion at the end of the feeding period is also rather good on a carcass gain basis, compared to liveweight feed conversion (see Fig. 1). Finally, even a $10-per-cwt. Prime premium on a carcass weighing 860 lb. nets $86 per head, certainly worth having. We’ll grant that when feedyards are faced with a rapidly declining fed-cattle market near the end of the feeding period, it is realistic that live-cattle sales and some groups deemed “safe but not great” for carcass quality could be short-fed to take advantage of a better market.

Editor’s note: Paul Dykstra is a beef cattle specialist with CAB. Read more of Dykstra’s biweekly comments in the CAB Insider at https://bit.ly/2FsInFp. Photo courtesy of CAB.