Supply & Demand

Cattle market continues on an upward trajectory based on weather market.

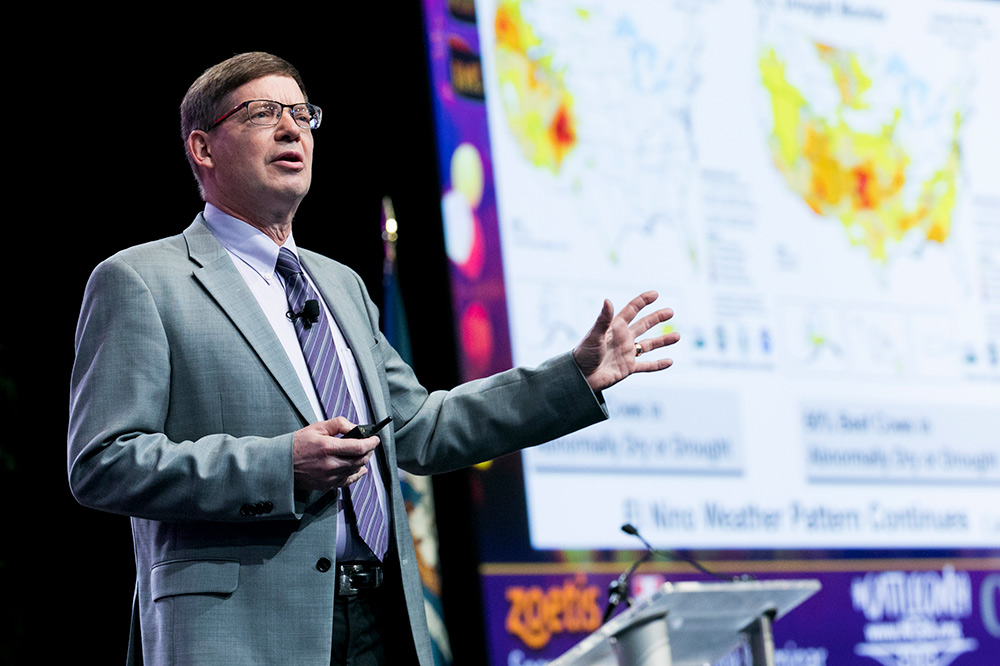

It’s a weather-market year. During the 2019 Cattle Industry Convention in New Orleans, La., CattleFax senior analyst Kevin Good said this will make the cattle market explosive in the spring and risky in the later summer months. Much like last year, his overall outlook for 2019 is positive, despite past and future challenges in the industry.

“Generally speaking, prices are strong,” he said, “available dollars coming in are a record high. Everyone in the cattle production system has had a good few years, but I would challenge producers to think about expansion as the strong domestic and global economy are sure to crumble at some point.”

Cattle slaughter numbers were up by 400,000 head last year and are expected to increase by another 150,000 head in 2019. CattleFax projects beef production will hit a record high at 27.3 billion pounds (lb.) in 2019 and level off in 2020 at 28.1 billion lb.

“We produced 3.2 billion more pounds of beef in 2018,” Good explained. “The balance of trade improved by 1.3 billion pounds between 2015 and 2018. Basically, exports are going up while imports are going down.”

This also means beef on the domestic market per capita will remain steady with the numbers from last year. This is not from a lack of supply though. In fact, the calf crop coming into the year is up by more 350,000 head.

“We won’t be able to harvest more cattle than we did a year ago — we were going five days a week plus most Saturdays — but we believe supplies will stay larger and longer into the fall,” Good added.

While poultry entered 2019 at a 10-year-low price, beef is still recognized as a premium product. Beef retail prices are expected to average $5.73 per lb. Demand for it is strong thanks to increased wages and job growth. Since 80% of fed cattle grade either Prime or Choice, retailers are seeing the benefit of advertising beef at a higher rate.

“The lack of shackle space at the packer will present a challenge as we move into the third quarter,” Good said, referring to July through October, the months he considers most risky in the coming year.

This will make selling cattle difficult for producers from a bargaining standpoint, Good added.

While exports continue to increase and appear to be “friendly,” Good is quick to point out how ongoing trade negotiations make this status volatile. Although, trade continues to be healthy for all three proteins — poultry, pork and beef — and Good expects that trend to continue in the coming year.

“African Swine Fever is spreading through China, and we expect this will open up more avenues for products going overseas later in the year,” Good said. “The 10% swing in pounds of beef traded equates to $300 million in the market.”

Weather conditions and profitability ultimately drive expansion. In the current weather market, Good said cattle will take longer to reach market weight. This will give the market more “push” through the spring months.

Essentially, the cattle industry is continuing its upward trajectory. However, Good cautioned producers to be thinking long term as he said conditions will eventually deteriorate, as they have historically in the cycle.