The largest carrot exists for cattle that will achieve at a high level for feedlot performance, carcass quality and eligibility for branded beef, as well as management label claims.

Think Like a Cattle Feeder

What a cow-calf producer needs to know about fed-cattle pricing.

When you’re in the business of selling something, it’s always a good idea to know more about what motivates your customers. The more you can deliver on what they want, the better chance you have at the best price.

If you’re set to market some feeder calves this year, it might be wise to momentarily adopt a cattle feeder’s point of view.

Calculating a breakeven

When trying to predict how much a cattle feeder can pay, it all starts by working backward from a live-cattle futures price for the month in which the finished cattle would sell. From there, the feeder would use current cost of gain projections to subtract out the feeding cost. They’re left with the amount they should be able to pay for a feeder calf.

That’s the simplified version, but there are a lot of factors to account for to refine the process.

If they intend to sell in a value-added scenario, they will use what they know (or think they know) about carcass quality of the feeder cattle they’re considering. Is it logical to pencil a premium, and how large should it be?

If the genetics suggest the cattle could reach a high percentage of Certified Angus Beef® (CAB®) brand and Prime carcasses, they can ratchet that predicted sale price a given number of dollars higher, affecting the potential purchase price similarly. Nearly 70% of all fed cattle are sold on a quality-based grid or formula, and many include aspects of carcass quality.

It works the same way across any management claims that we’re pursuing on the finished product. The lion’s share of feeder cattle fit a conventional definition. However, cattle with the management and genetic “extras” are purchased with the intent of targeting a premium market.

Cattle feeders generally won’t pay a premium unless they’re fairly certain they’ll get one when they sell the finished product. Feeders who buy these calves with added verifications are likely aligned with one or more packer programs to produce branded beef with superior carcass quality, and product label claims for specifications such as natural, non-hormone-treated cattle (NHTC), Global Animal Partnership (GAP) compliant, etc.

Let’s never lose sight of the importance of health, feed conversion and average daily gain. Historic knowledge of how a ranch’s calves perform remains the best evidence to build buyer confidence in these projections. However, the ranch’s management is a huge factor and can vary from one year to the next. Weather and feed resources also govern how much recent history will play out in the current year in terms of health and ability to thrive.

Paul Dykstra shares his market analysis knowledge with cattlemen at industry events throughout the year around the country. |

The more confidence the rancher can give the buyer, the more interest the buyers will likely have in paying a premium.

Risk management is also such a big component of today’s cattle feeding world that we can’t emphasize enough how commodity futures prices affect buying decisions.

They’ve gotta be worth it

Generally speaking, the largest carrot exists for cattle that will achieve at a high level for feedlot performance, carcass quality and eligibility for branded beef, as well as management label claims. Packer premiums for these fed cattle trickle back in the form of premiums paid for feeder cattle that fit the description and have the required third-party verifications.

Feeder-cattle prices tend to signal what factors justify a premium. Still, communicating demand and potential premiums remains a bit of an inefficient system. Unfortunately, there’s not a manufacturer’s suggested retail price (MSRP) listed anywhere for cattle. We can only look at long- and short-term history to determine what traits and programs to pursue, and at what cost we can achieve them while still penciling a return on investment from the cow-calf and feeder segments.

To better understand what feedlots will most highly demand, it’s a great idea to forge some relationships with reputable cattle feeders who are likely customers of your cattle. Implementing management and genetic decisions that fit the bias of the market trend may not pan out precisely as we expect, but superior cattle with great management will normally find the top end of the market.

Of course, cyclical influences will always help set the base price.

Heed historical trends

Feeder-cattle and fed-cattle prices tend to be quite correlated over time, particularly true when looking across months or even years. When a trend shift takes shape in fed cattle, this trend will also emerge in feeder-calf prices. However, prices for the two classes of cattle are certainly not tied together in lockstep.

Cyclical changes in feeder-cattle supplies commonly change the price spread between feeder calves and fed cattle, and lasting shifts in feedlot costs have an effect. In the shorter term, we also observe that live-cattle futures prices several months ahead (deferred futures) often suggest a needed shift in immediate feeder-cattle prices before current cash fed-cattle prices make a correction.

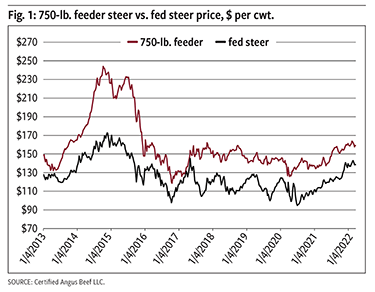

In the past decade, the fed-cattle prices have been a story of many variables (see Fig. 1). The 2010-2012 drought resulted in fewer fed cattle as ranchers raised fewer calves and needed to retain more replacement heifers through 2015 to build back.

Feeder and fed-cattle prices clearly reacted to the supply deficit with the cycle-high prices enjoyed in late 2014. In 2015 prices were near the prior year, but slightly lower. By the fall of 2015, the tide turned.

Packing sector contraction traces all the way back to 2008 with the loss of the Tyson plant in Emporia, Kan. More pertinent to the cattle supply through the drought, the Cargill plant in Plainview, Texas, closed, followed by the National Beef plant in Brawley, Calif.

Annual U.S. cow herd inventories began to increase in 2015 with the subsequent increase in feeder-cattle supplies. However, the smaller packing capacity coupled with record-heavy carcass weights late in 2015 shifted leverage away from the feeding sector in favor of packers.

Outside of a healthy spike in fed-cattle prices in 2017, the period thereafter saw normal peaks and valleys, but a slow average degradation in fed-cattle prices until the spring of 2020.

COVID-19 brought about the backlog in fed cattle, resulting in dramatically faltering fed-cattle prices in the immediate wake of temporary plant closures and very slow recovery in plant processing speeds.

Since July of 2020, fed-cattle prices have battled back, summarily increasing by more than $40 per hundredweight (cwt.), or roughly 45%. However, this brings the market still short of the 2017 price highs and, unfortunately, we’ve seen no real inflationary pricing trend for fed cattle, only recovery from depressed prices due to loss of leverage.

There’s nothing rosy about that reality, but it’s been on the top of cattle feeders’ minds for some time.

What to do with what you know

At the cow-calf level, we really ought to pay attention and stay attuned to what cattle feeders are experiencing. There’s clearly a bit of an adversarial relationship between buyer and seller, but this doesn’t need to impede market signals from being passed back.

While cattle feeders are incentivized to pay as little as necessary for feeder cattle, competition forces the market toward true market discovery. The customer drives trade, and realizing customer problems and desires helps us better our position to answer those needs.

The marketing aspect of producing feeder cattle is key. The time-tested recipe to success is creating a favorable impression of our product with as many potential customers as we can.

Technology now allows us, as cattlemen, to tap into more tools (think DNA and internet connectivity) than we’ve ever had to better align the verifiable attributes of our cattle to buyers that are also as informed as they’ve ever been.

It’s a simple equation that takes a fair deal of attention: To get top feeder-cattle prices, you have to make sure you have the kind of feeder calves that will be set to earn top fed-cattle prices.

Editor’s note: Paul Dykstra is CAB director of supply management and analysis. Photos courtesy CAB.

Angus Proud

In this Angus Proud series, Editorial Intern Jessica Wesson provides insights into how producers across the country use Angus genetics in their respective environments.

Angus Proud: Scott Sproul

Angus Proud: Scott Sproul

Oklahoma operation learned wisdom of moving calving season to better suit their marketing needs.

Angus Proud: Bubba Crosby

Angus Proud: Bubba Crosby

Fall-calving Georgia herd uses quality and co-ops to market calves.

Angus Proud: Jim Moore

Angus Proud: Jim Moore

Arkansas operation retains ownership through feeding and values carcass data.

Angus Proud: Stephen Shiner

Angus Proud: Stephen Shiner

Idaho operation rotates pastures in summer and raises crops for winter.

Angus Proud: Brian Nusbaum

Angus Proud: Brian Nusbaum

Angus cattle fit cattleman’s marketing goals and helped him set out on his own.

Angus Proud: Les Shaw

Angus Proud: Les Shaw

South Dakota operation manages winter with preparation and bull selection.

Angus Proud: Jeremy Stevens

Angus Proud: Jeremy Stevens

Nebraska operation is self-sufficient for feedstuffs despite sandy soil.

Angus Proud: Dave Rutan

Angus Proud: Dave Rutan

Angus breeder gets the most out of his bull investment by partnering with opposite calving-season operation.

Angus Proud: Nickey Smith

Angus Proud: Nickey Smith

AngusLink helps Louisiana cattleman gain more for his calves.