Packer Margins Fall as Head Counts Decrease

Fed-cattle weights trend counter-seasonally higher.

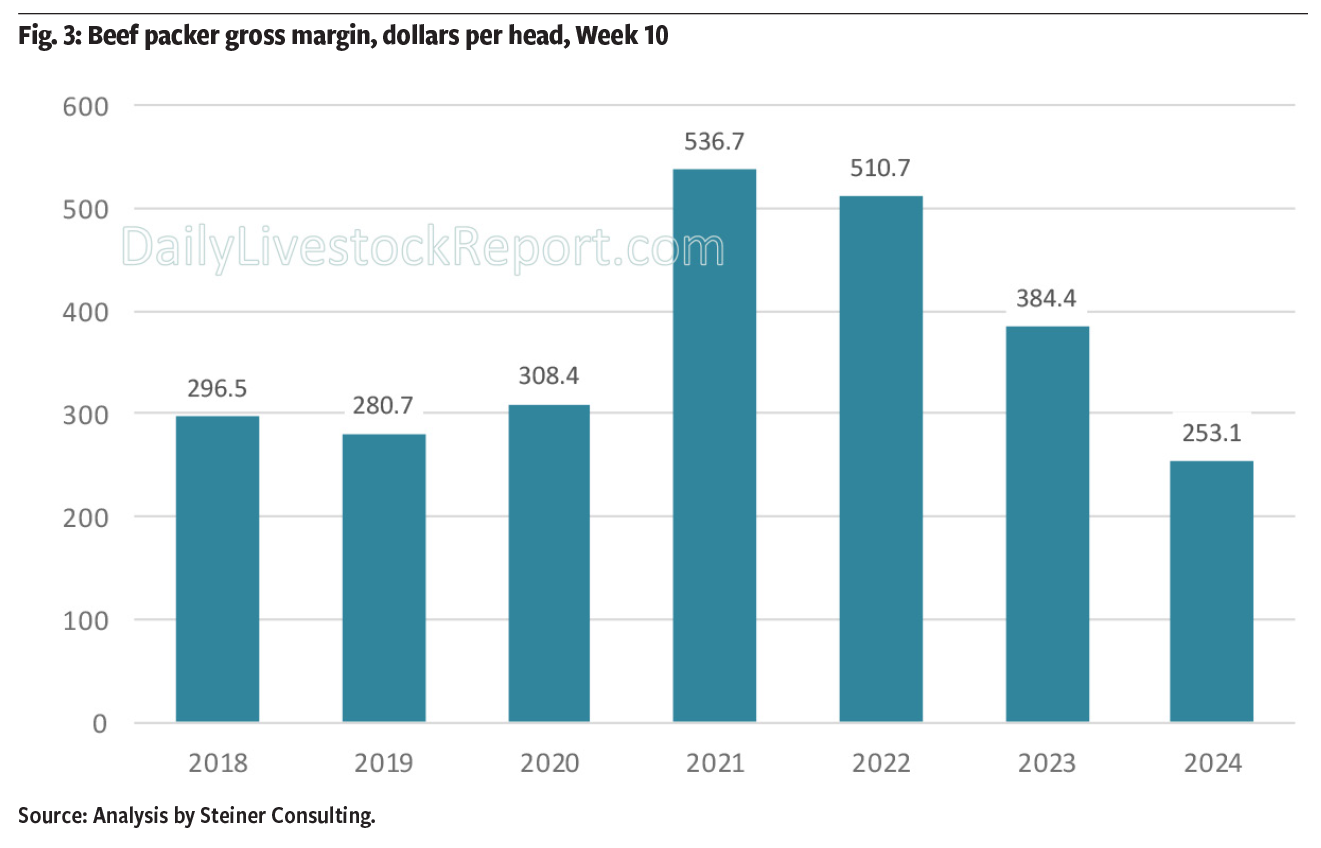

Fed-cattle futures turned sharply lower March 14. Technical factors may have driven the reversal, but as we look at supply data, a couple of things stand out. Packers continue to struggle with margins, with the gross margin currently well below pre‐pandemic levels. Remember, the labor cost structure is very different today than it was five years ago, and other operating costs have moved up, as well. We don’t have data that’s good enough to calculate net margins, but some people out there think packers are about $80 per head in the red. For our purposes, the gross margin calculation makes the point.

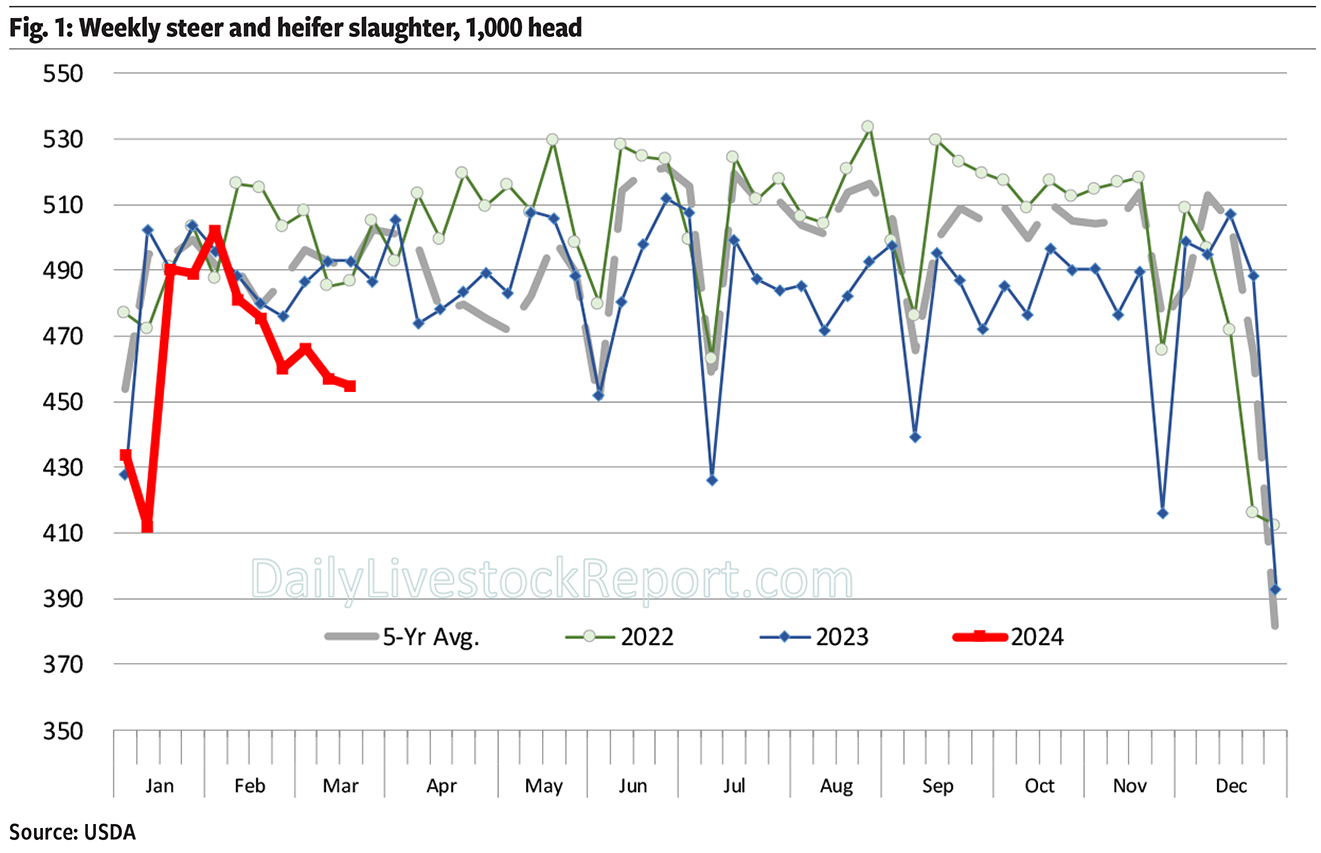

The margin squeeze has put a lid on fed-cattle slaughter for now. Packers largely eliminated Saturday slaughter in 2023. Now they are forced to run lighter schedules on Mondays and Fridays. Monday slaughter Feb. 12-March 4 averaged 88,000 head, down almost 4,000 head vs. the same time last year. That trend continued Monday, March 11, with slaughter at 87,000 head vs. 97,000 last year. Friday slaughter has declined even more. Feb. 16-March 8 it averaged 84,000 head, down almost 8,000 head (‐8.2%) compared to the same time last year. Our current estimate is for fed-cattle slaughter for the week ending March 16 to be around 455,000‐460,000 head, down about 7.5% compared to last year. For the four weeks ending March 16, fed-cattle slaughter is projected down 5.6% year over year.

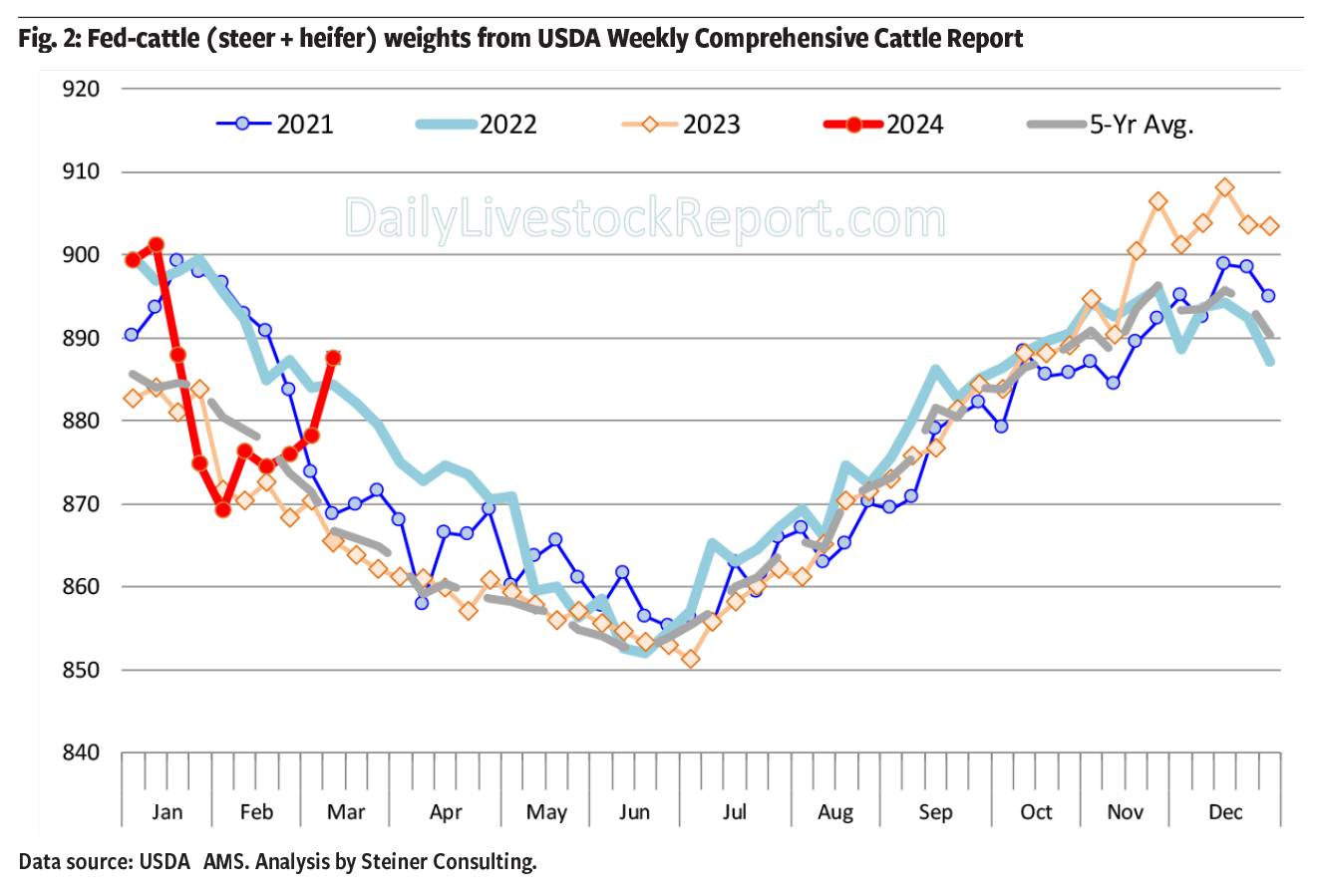

The sharp pullback in slaughter and warmer-than-normal weather in the Midwest have caused fed-cattle weights to do a U‐turn, trending counter-seasonally higher. The official USDA weight data for the week ending March 2 had steer weights up 5 pounds (lb.) from the previous week and 20 lb. (+2.2%) higher than a year ago. Heifer weights jumped 12 lb. from the week before, and they were 17 lb. (+2.1%) higher than last year. Weights likely continued to push higher during the week ending March 9. Fig. 2 shows a weighted average of both steer and heifer weights updated through last week. It shows weights for the week ending March 9 up 2.5% from a year ago. The increase in weights has helped offset some of the reduction in slaughter. It has also bolstered availability of fat trim, helping keep 50CL prices a bit more in check.

Feedlots have held the line on prices, considering the high cost of feeder cattle and the incentive to put as much weight as possible on current inventory before they go out the door. But, how much more upside do weights have and when does that start to affect spot prices? That’s the current guessing game, we think.

The trend in the cutout remains critical. Will packers be able to keep rounds and chucks at these levels, when normally they decline? Will foodservice demand improve enough to carry a higher share of the cutout? Loins have started to march higher, but ribs remain in check. Whether ribs catch in April or May will be important in evaluating April and June price potential.