Higher Land Values, Cash Rents

USDA reports on 2022 trends in land values, cash rents.

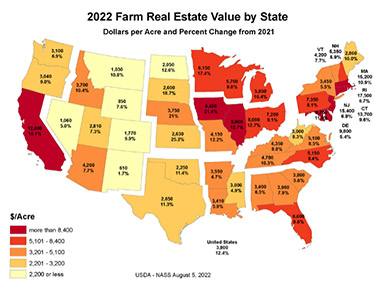

Survey findings from the USDA-National Agricultural Statistics Service (USDA-NASS) estimated Nebraska farm real-estate values, including all ag land and buildings, in 2022 increased by 21% to an average of $3,750 per acre (see Fig. 1). The year-over-year increases mark an increase of $650 for this annual period (USDA-NASS 2022a). Kansas and Iowa led the nation for the highest rates of increase in the market value of farmland, at 25.2% and 21.4% for market value averages of $9,400 and $2,630 per acre. Nebraska marked the third-highest percentage increase for rising farm real estate when ranked against the other states.

For the second year in a row, cropland values in Nebraska reported the second-highest increase in the nation at 21.0%, increasing to an average of $6,000 per acre. Kansas led the country with a rise of 24.5% to a new average of $2,950 per acre (USDA-NASS 2021a). Many of the cropland purchases capitalized on the high commodity prices fueled by disruptions in global trade and drought conditions across the major grain-producing regions of the United States. Monetary policies gradually increased the cost of borrowing during 2022 to combat inflationary pressures. Rising interest rates and input expenses may weigh down future cropland values, unless offset by increasing farm profitability.

Pastureland values increased at a lower rate than cropland values across Nebraska, as many grazing areas experienced drought in 2022. Year-over-year pastureland gained 14.8% to a new average of $1,240 per acre in Nebraska. Disaster assistance helped offset some of the pressures placed by drought on cattle producers, but margins remain tight in many operations. Culling breeding stock or acquiring additional forages were some of the strategies utilized by livestock producers to deal with drought pressures. Either approach may have financial ramifications on the operation and outlook on profitability for the industry into the future.

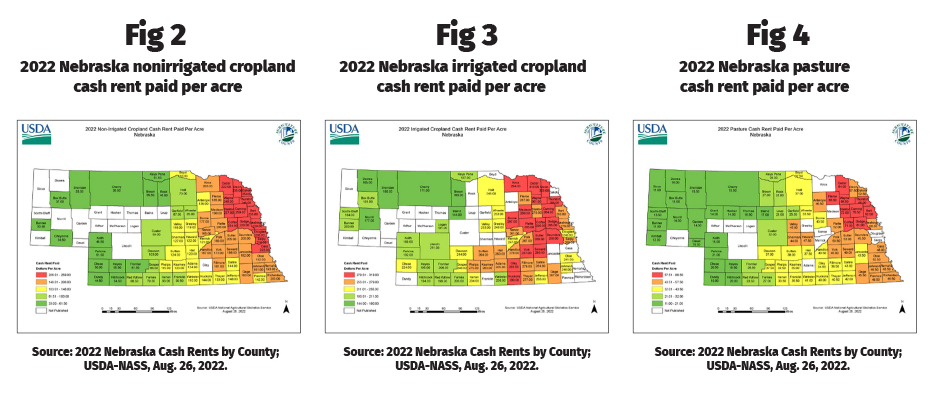

The USDA-NASS reported county-level cash rent estimates for the 2022 growing season in Nebraska (USDA-NASS 2021b). These estimates include cash rent averages for nonirrigated and irrigated cropland, along with pasture, on a per-acre basis. Differences in nonirrigated cropland rental rates in Nebraska are attributable to differences in soil type, rainfall, yield expectations, and general market competitiveness of different counties (see Fig. 2). Counties indicated in white did not have enough surveys returned by participants to estimate a rate or are in an area of the state with a low rate of that particular production practice.

Trends reported for irrigated cash rental rates in 2022 reflect those reported for nonirrigated cropland (see Fig. 3). Higher cash rental rates for irrigated cropland are noted in the eastern half of Nebraska compared to the western region. Irrigated areas with low response rates to the cash rent survey or those with low numbers of irrigated acres did not report rates. The irrigated cash rental rates do not distinguish between center-pivot and gravity- or flood-irrigated acres. The reported irrigated average reflects a weighted average of the county’s center-pivot, gravity-, and flood-irrigated practices. The reported rates also assume the landlord owns the entire irrigation system on the property leased to the tenant. Rates may be adjusted when the tenant provides the pivot, power unit or other irrigation system components.

- USDA-NASS. (2022, Aug. 5). Land Values 2022 Summary. Retrieved Dec. 13, 2022.

- USDA-NASS. (2022, Aug. 26). 2022 Nebraska Cash Rents by County. Retrieved Dec. 15, 2022.

Nebraska’s land and pasture rental rates reflect the differences in stocking rates, productivity, and market competitiveness (see Fig. 3). Reported rates reflect the amount paid during the summer. Off-season grazing rental rates during the fall, winter or spring calving season may be adjusted to reflect forage dormancy, quality or other features of the property. This off-season period may also be adjusted by winter snowfall or other weather features.

Additional details on the USDA-NASS land values and cash rental publications may be found in the reference section of this article.

Editor’s note: Jim Jansen is an ag economist and Jeff Stokes is professor of ag economics at the University of Nebraska–Lincoln. This article was provided by UNL’s Institute of Agrictulture and Natural Resources for the Center of Agricultural Profitability. Lead photo by Erin Ehnle Brown, realagstock.