Late-breaking news:

CattleFax Analyst Says Conditions Are Right

Part I: The pieces are aligning for herd rebuild to begin this fall.

For expansion of the nation’s cow herd to occur, you need cash, and you need grass, CattleFax Analyst Troy Bockelmann said during the group’s May 24 outlook webinar. “If you have both of those things, you can start to get some calves.”

Pointing to factors improving both feed supplies and cow-calf profitability, Bockelmann said, “We’re starting to see the tides turn.”

As the pieces begin to align to encourage rebuilding the nation’s beef cow herd, he stressed the importance of focusing on genetics, nutrition and quality.

Improving feed situation

Bockelmann shared a significant change in the drought index since November 2022, when only 14½% of the country had adequate moisture, while the remainder faced extreme drought, drought or dry conditions. As of May 18, 2023, 58% of the country had adequate moisture and conditions were improving.

In addition, the May 12 World Agricultural Supply and Demand Estimates (WASDE) Report by USDA indicated the stocks-to-use ratio for corn is changing to favor those feeding. Stocks-to-use is the ratio of the market year’s ending stocks vs. domestic consumption of the commodity. A higher stocks-to-use ratio means more supply is available and generally indicates a more favorable price to buyers.

Fig. 1: U.S. Corn Projected Stocks to Use And Monthly Avg. Spot Futures Price

Click here to see a larger image |

“We went from a 10.3% in old-crop corn to a 15.3% in new-crop corn,” Bockelmann said (see Fig. 1). “We’re talking about 92 million planted acres and a trend-line yield of 181.5 bushels (bu.) per acre, ultimately ending in total use up 755 million bushels compared to production up 1.535 billion bushels.

“I understand, you know, hogs eat more $4 corn than they do $8 corn. Same thing with cattle,” he continued. “But, I understand that as production decreases, there’s room in the balance sheet to keep stocks-to-use above that 14% as we go forward.”

As a result, corn futures prices are trending lower and could average $5 per bu. in the fourth quarter, Bockelmann said, recognizing that there are a lot of factors still in play with only 81% of the corn crop even planted. “Ultimately, with a 14% or better stocks-to-use, we’re going to see some relief — not only in corn futures, but corn basis, as well.”

The hay situation may take a little more time to rebound, he said, noting that the 2022 hay crop was the smallest since 1959, and Dec. 1, 2022, hay stocks were the smallest since 1954.

“With 1.1 million more acres of hay and just a slightly better yield than the last couple years, you could see production increase 8%, or 8.8 million tons,” he said. While not a relatively huge number, it should bring some price relief.

From a herd view

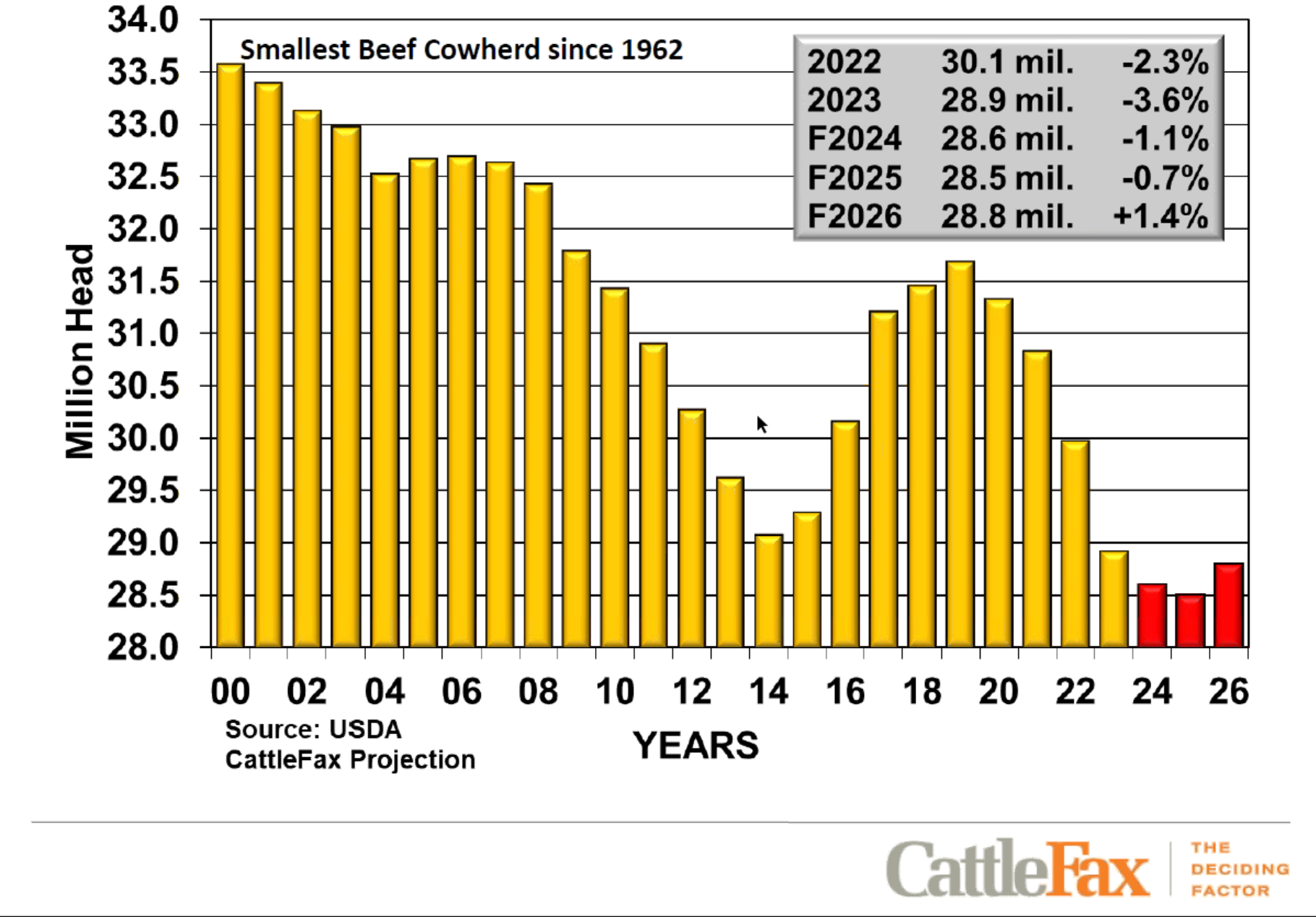

In 2019, at the cycle high for beef cow inventory numbers, more cattle were going to market than there was shackle space, or harvest capacity, said Bockelmann. “Now look: We have beef cow inventory numbers below where we were in 2014, and we would expect going into 2024 that we are still going to liquidate that beef cow herd (see Fig. 2).”

Fig. 2: Beef Cow Inventory

Click here to see a larger image |

Cow slaughter numbers imply a culling rate of 13.4% in 2022 — the highest culling rate since 1957, said Bockelmann, and there are too many heifers in the slaughter mix headed to the feedyard to start to see expansion of the herd.

Interest rates are a major factor slowing the herd rebuild. In analyzing the operating costs to carry a cow for a year, the interest costs — at almost $60 per head — are double what they were a year ago, he pointed out. Stocker operators and feedyards are also feeling the pinch of higher interest rates.

“Ultimately, your total [interest] costs have doubled from a year ago when you’re talking about going from a cow-calf all the way to the feedyard sector,” Bockelmann noted. “So there [are] some additional input costs that are going into producing that calf that need to be accounted for this year.”

If producers begin to increase the cow herd inventory, will demand be there to buy the supply?

“Yes,” said Bockelmann, explaining that while demand may have softened from a year ago, it is still strong.

Calculated demand appears softer, he explained, because the retail price is not keeping up with the rate of inflation, let alone tighter supplies of beef. Restaurant and retail purchasing behaviors surrounding the COVID pandemic already incorporated inflation on the beef side.

Consumers have also made it clear that they want higher-quality beef — upper two-thirds Choice and Prime — and they are willing to pay for it, said Bockelmann. “That’s important as we think about this rebuilding of the beef cow herd. What animals are we putting back into the system?”

Stay tuned for Part 2.