In the Cattle Markets

Meat export expectations for 2015.

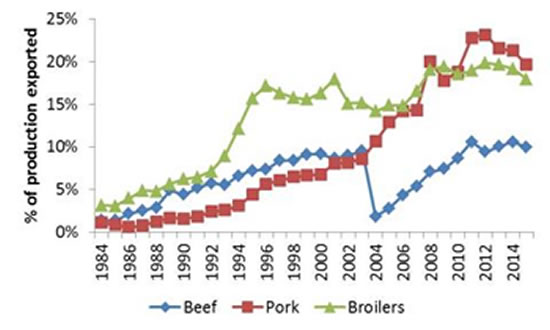

Exports are an important component of demand for all three of the major meat species. According to the most recent data, exports of beef, pork and chicken amounted to 21%, 19% and 11% of production, respectively, in 2014. All of these figures are high by historic standards, but none is a record for the share of production exported. Fig. 1 shows exports as a share of total production for beef, pork and chicken from 1984 through 2015 (forecast).

Clearly, exports have become an important part of the market for all of these products. For chicken, exports became a really significant factor in the market with the fall of the Iron Curtain, which resulted in improved market access in Eastern Europe and Russia. For pork, exports really took off in the early 2000s, with a major boost from China as purchasing power in that country began to grow. Plus, of course, beef exports grew more-or-less steadily through the 1990s before being severely set back at the end of 2003 with the discovery of the first U.S. case of bovine spongiform encephalopathy (BSE).

Source: USDA Foreign Agricultural Service.

What is as noticeable as the periods of growth in exports is the fact that exports (again, as a share of production) have not grown for the last few years. In fact, for 2015, USDA’s most recent forecast has exports declining for beef, pork and chicken as a share of production, as well as in total pounds. In fact, if that forecast holds, it will be the second straight year in which exports of beef, pork and chicken have all declined together. That has really never happened — at least not since exports became a meaningful component of these markets.

Combined, beef, pork and chicken exports in 2015 are currently forecast to decline by 485 million pounds (lb.) (beef down 173 million lb., pork down 108 million lb., and chicken down 204 million lb.). There have been larger annual declines in combined exports before. In 2004, beef exports alone declined by more than 2 billion lb. In 2009, following the Olympic-fueled boom in pork exports to China in 2008, pork exports fell by 572 million lb. In 2002, chicken exports fell by 748 million lb. due to Russia’s first really serious export ban. Yet, it is unusual to see all three species decline together, and the combined 485-million-lb. drop in red meat/chicken exports will be, if realized, among the bigger year-over-year declines in the last 20 years.

Why the weakness in exports this year? There are several factors at work. For one thing, beef, pork and poultry are historically quite expensive. Relatively tight production, particularly when considered on a per-capita basis, and strong domestic demand have helped push prices to record levels. This alone would tend to reduce exports (ceteris paribus, of course).

Adding to the impact of higher prices for foreign consumers is a very strong dollar. While it doesn’t seem to be attracting as much attention this time around, the dollar is actually stronger on a trade-weighted basis than it was during the financial crisis in 2009. This makes U.S. meat (and, in fact, all U.S. products) more expensive for foreign consumers in terms of their home currency. Finally, the West Coast port disruptions got exports off to a very slow start this year. Some of that ground may be made up as the year progresses, but it will not necessarily be easy to do.

Editor’s Note: John Anderson is the deputy chief economist for the American Farm Bureau Federation.