In The Cattle Markets

The feed situation and its effect on expansion.

Beef cattle inventory levels have been expected to continue to remain low. Feed availability has been a limiting factor in recent years. Feed costs have also limited profits for cow-calf producers.

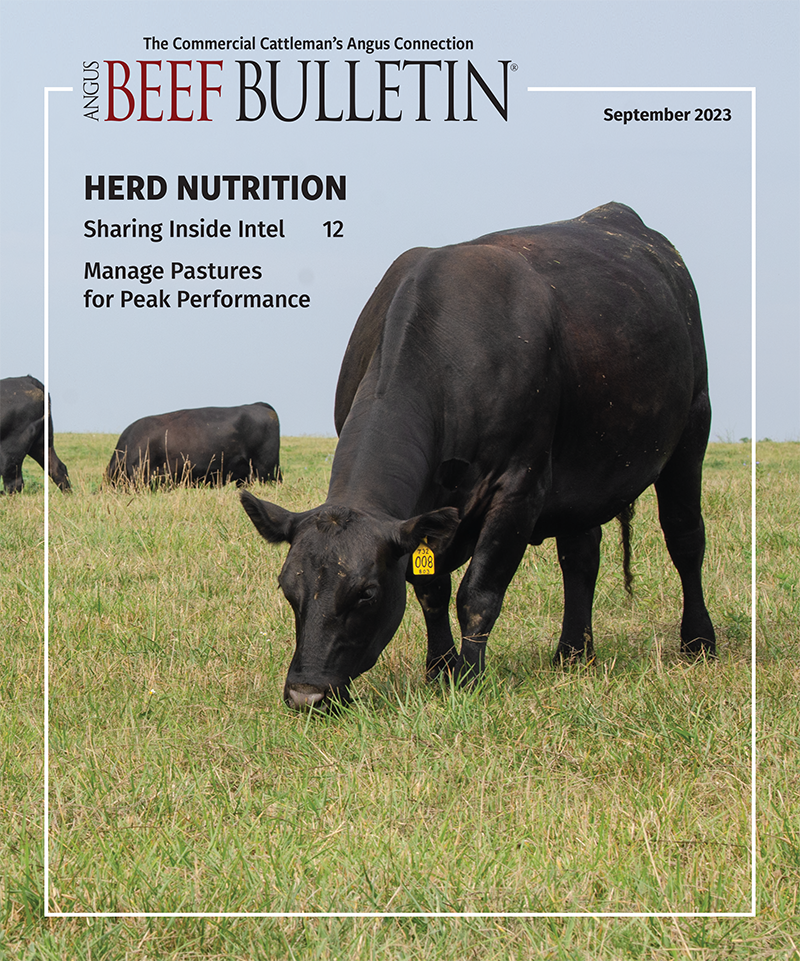

Heading into fall, there are a few signs of changing aggregate conditions that may allow some expansion to begin. The largest change is probably on the range and pasture side, where the latest conditions show much higher percentages in the continental United States in good or excellent condition compared to a year ago (see Fig. 1). There are also much lower percentages in very poor or poor relative to last year.

While conditions are subjective, their consistency and direction would be considered an improvement. The reduction in inventory levels has also meant less demand on pastures. In general, conditions are better in the eastern United States and worse in the Southwest.

Feed consumption indexes

The Economic Research Service (ERS) tracks and builds indexes of grain, high protein, and roughage-consuming animal units. The roughage-consuming units are dominated by cattle, mainly grazing, and then dairy animals.

Several years in a row of declining units means less demand for feed, particularly for forage. The grain-consuming units are spread across hogs and poultry, then cattle feedlots. That index has not changed much in recent years.

The high-protein index is dominated by poultry, and it has been increasing slightly in recent years. Thus, pasture demand has gone down, but demand for other feed has been constant when aggregated across other livestock.

Hay availability

The hay situation has improved from a buyer’s perspective. Production is up sharply from a year ago, mitigating a slightly tighter old stocks situation. Thus, supply is larger. Fewer roughage-consuming units translates into lower demand. Both combine to push down prices.

A major demand source in recent years has come from hay-importing countries. In part, high prices seem to have slowed trade, meaning more tons are available in the domestic market.

Regionally, the corn crop has a high level of variability. There have been anecdotes of low grain yields expected in different areas, even though the plant height is normal. That suggests more corn than normal may be switched to silage production. This can result in substantial tons of forage, albeit at lower energy levels than if the grain production were normal.

Distillers’ grains will likely make up any ration needs.

The most obvious effect of changing feed prices will show up in continued changes to the price slide across feeder-cattle weight classes and the price spread between steers and heifers.

The expected price of corn is much lower than a year ago. This has helped support calf prices and made the slide steeper than a year ago. The spread would also widen, reflecting the better gain of steers over heifers.

However, if feed availability improves and costs fall, cow-calf producers may look favorably on heifers as replacements, which could narrow the spread.

Editor’s note: Matthew Diersen is a risk and business management specialist for the Ness School of Management & Economics at South Dakota State University.