Select Carcass Value Pressure

Select product devalued and represents a shrinking demand category.

High-quality, premium branded-beef products would offer little value to the production sector in the absence of price differentiation. The fact that premiums exist and opportunities to charge more for higher quality are the drivers of the system.

For decades the beef supply chain has factored the Choice-Select price spread as the standard by which we measure demand for beef cuts. A wider spread signals strong demand from the market for marbling, while a narrow spread suggests weaker demand for the same.

We don’t often focus on the Select carcass trends, but it is informative to do so in the face of shrinking supplies in that category. During the past decade alone, production of Select carcasses has fallen by nearly 50% in relation to Choice and Prime. So far in 2020, the Select proportion has been 13.8% of fed-cattle carcasses, following the 2019 total of 16.9%.

Realizing that Select supplies have dramatically declined is important as we look at demand for Select beef. Price and volume are the two drivers that define demand. With Select supplies becoming smaller and smaller, we might assume that scarcity could drive prices higher, given healthy demand.

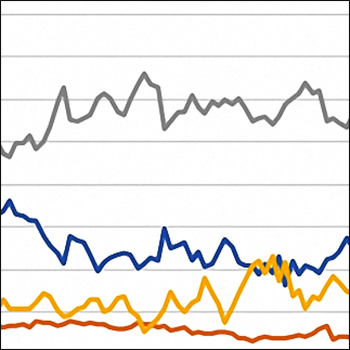

The chart in Figure 2 doesn’t specifically define demand for Select beef, but it does show an interesting relationship between Select and No Roll carcass cutouts. No Roll carcasses are those that are practically devoid of marbling and, consequently, do not receive a grade at all. The chart shows that during the past two years, with the exception of this May, the spread between Select and No Roll carcasses has narrowed. Highs in that price spread that previously touched $20 per hundredweight (cwt.) were reduced to $12 per cwt. beginning in 2018. The lows in the comparison are also slightly lower in more recent years, while the range from highs to lows has also narrowed.

This suggests that Select-grade beef products are being met with less and less demand. The U.S. retail sector can be credited with embracing higher-marbling beef products. Not only has Choice surpassed 70% of the fed-cattle supply, but the Certified Angus Beef® (CAB®) brand is often 20% of the total, while Prime has been as high as 12%. Greater availability of the premium beef products is key to retailers’ ability to feature high-quality beef and count on a consistent supply in volume.

With Select product devalued to this extent and representing a shrinking category, we need to embrace the change. Low-Choice is no longer a premium, but the low-water mark. Producers and end users alike should begin their beef quality conversations with premium Choice and Prime branded products with specifications. This is the “new normal” and the key to demand today and tomorrow.

Editor’s note: Paul Dykstra is the assistant director of supply management and analysis for Certified Angus Beef LLC. Read more of Dykstra’s biweekly comments in the CAB Insider at http://bit.ly/CABinsider1028.